MARGIN & MARKUP

Margin & Markup – these are two terms you’ve likely heard often. What is the difference & why is it important?

Briefly, ‘margin’ is calculated by subtracting the cost of goods sold from total sales for a given period. On the other hand, ‘markup’ is an amount or percentage of profit derived over the cost of the product. Both are critical in setting prices and determining profitability.

They both consider the relationship between ‘price v cost’, but with a different outlook or perspective.

Understanding the Relevant Terms

There are several accounting terms you need to be familiar with in order to find & understand both margin & markup:

- Revenue/Sales:

This is the income you earn selling your products and services before any deductions.

- Cost of Goods Sold (COGS)

These are the expenses necessary in making your products and providing services. As well as materials, things like direct labour costs are also included.

- Gross Profit

This is revenue minus COGS

Calculating Margin

Margin is a function of sales & is calculated as follows:

- (Selling Price – Cost Price)/ Selling Price

- The first part calculates the Gross Profit which is then divided by Revenue to determine the margin.

- To express this as a percentage, simply multiply the margin by 100.

This is best illustrated in a practical example. Let’s say your business sells footballs & sells a particular ball for $100. It costs you $65. What is the margin on each football you sell?

Step 1: Calculate your Gross Profit

$100 – $65 = $35

Step 2: Find the Margin

$35/$100 = 0.35

Step 3: Express as a percentage

0.35 x 100 = 35%

For every dollar ($) of sales you make, you keep $0.35 – you spent the other $0.65 buying or manufacturing the football. The higher your margin, the more you keep when you sell an item.

Calculating Markup

Markup reflects how much greater your selling price is than the amount the item cost you, calculated using the following formula:

- (Selling Price – Cost Price)/Cost Price

- Again, the first part calculates the Gross Profit but that result is divided by the Cost Price to determine the markup

- To express the markup as a percentage multiply it by 100.

We will use the same example, but this time calculate the markup.

Step 1: Calculate your Gross Profit

$100 – $65 = $35

Step 2: Find the Markup

$35/$65 = 0.54

Step 3: Express as a Percentage

0.54 x 100 = 54%

The markup formula measures how much more you sell an item for than what you paid for it. In this example, you sold a football for 54% more than you paid for it.

Relationship Between Margin & Markup

Margin & Markup are based on mathematical formulae & their relationship behaves in a predictable manner. Each Margin relates to a specific Markup & vice versa.

As we’ve seen, Markup is calculated by reference to cost price whereas Margin is calculated using Sales or Revenue. As sales will be of greater value than cost, rule of thumb is that Markup percentage will always be greater than Margin. If it is the opposite, your business is not profitable.

The following table best illustrates the relationship & you can observe how a change in Markup affects Margin at different points or intervals. The chart may also be used if for example you know the Markup on a particular item you sell but want to determine the resultant Margin.

Margin | Markup |

13% | 15% |

16.7% | 20% |

20% | 25% |

23% | 30% |

25% | 33.3% |

28.6% | 40% |

30% | 43% |

33% | 50% |

42.9% | 75% |

50% | 100% |

Why Does it Matter - Margin & Markup?

From the above examples, you can see that the two terms are related but provide different perspectives in relation to profit. Understanding the difference will help you set both short- and long-term business goals and strategic initiatives.

Understanding these terms, means you are able to price your products or services correctly to make sure you return a certain profit level and to ensure your pricing structure is competitive. Under-pricing items may win you customers or clients, but it’s unlikely your business will remain profitable in the longer term.

Conversely, if your products or services are overpriced, you may lose important customers to industry competitors.

Markup

Markup is crucial when a business is just starting out, as it establishes and measures the profit on each item or product you sell. For the same reason, quantifying Margin is essential when introducing new lines to your business.

Markup should be reviewed regularly as the cost of what you manufacture or purchase for resale may vary – remember Markup is a function of ‘cost’.

Margin

Margin is equally important as it shows how much of every dollar of revenue or sales is flowing to the bottom line – that is, how profitable your operation is. An acceptable or healthy Margin varies across industries – some operate on very low margins (i.e. single digits), whilst others traditionally enjoy much higher margins & this needs to be kept in mind when evaluating your Margin.

Examples of low Margin businesses include grocery stores, low end retailers and airlines. In these competitive industries, businesses have to sell a large number of goods or services to produce a profit equivalent to a high Margin entity (e.g. high-end retailers, jewellery operations).

Businesses in low Margin industries need to monitor Margin very carefully as even the slightest shift can have an enormous impact on their performance & profitability.

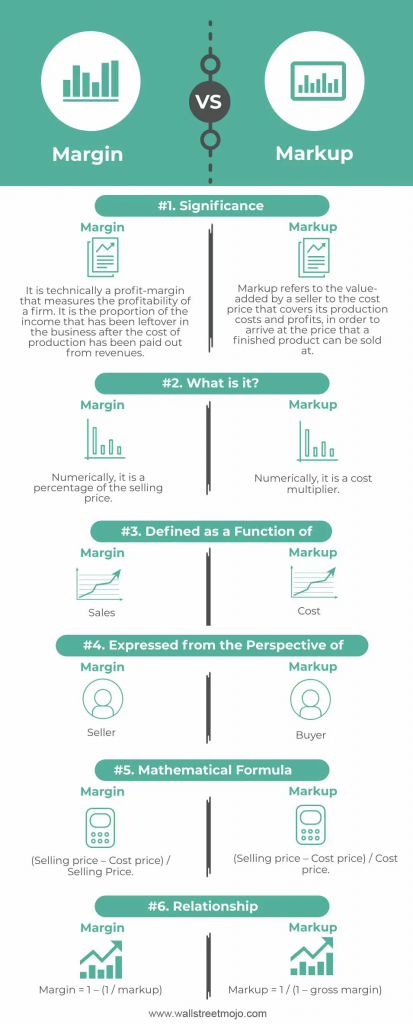

This infographic should help you understand the various relationships between Margin & Markup.

Source: Margin vs Markup (wallstreetmojo.com)

https://www.wallstreetmojo.com/margin-vs-markup/

Conclusion

Margin & Markup should not be confused – they are two different, but related mathematical functions. Both assist you in setting prices and measuring productivity, but they reflect profit differently.

Business owner’s need to understand that critical difference when planning and implementing both short-term and long-term goals and strategies.

Do you need more help understanding Margin & Markup?

Your first consultation is 100% obligation FREE.